taxable income malaysia 2017

Personal income tax rates Direct federal tax on income for 2021. Detailed description of taxes on individual income in Sri Lanka Concessionary tax rates.

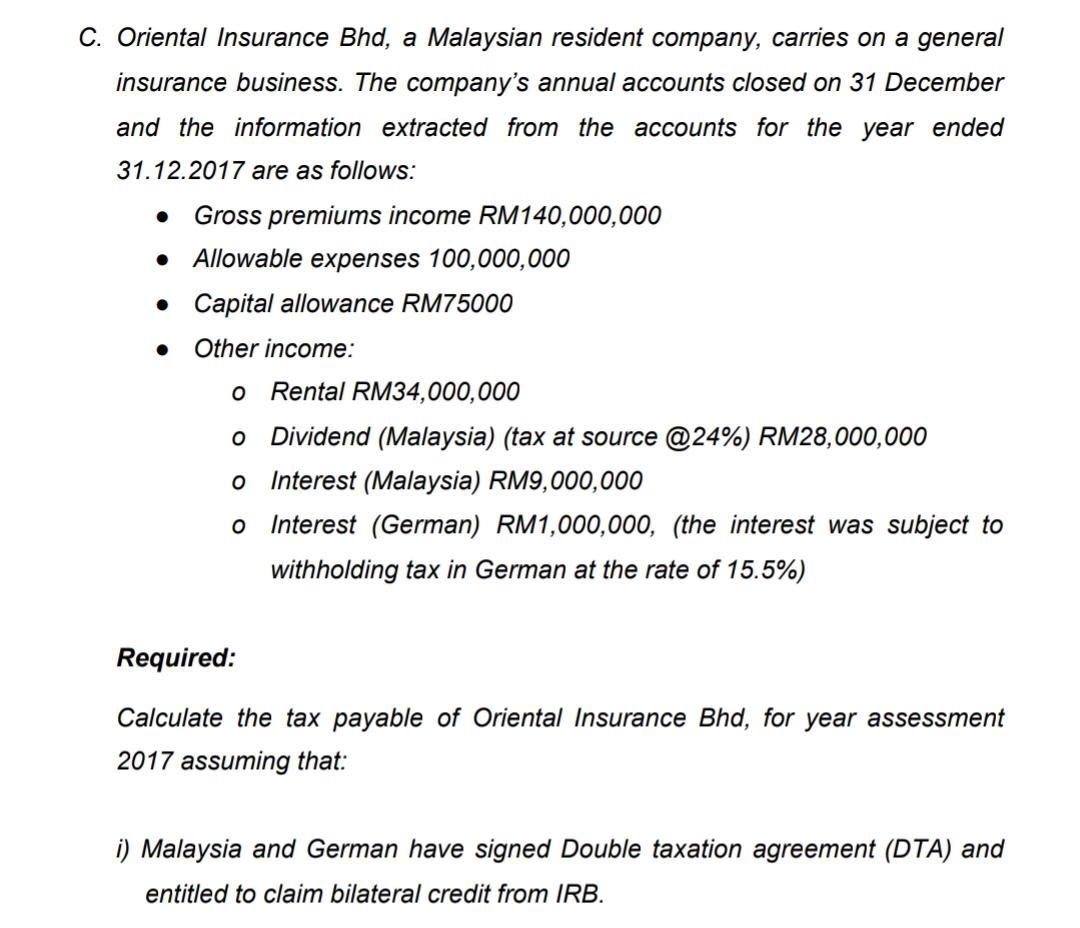

C Oriental Insurance Bhd A Malaysian Resident Chegg Com

Based on applicable double taxation treaties DTTs the actual taxable income in Switzerland may differ from the tax rate determining income.

. Concessionary tax rates apply to sums paid to an employee on cessation of employment when the scheme is uniformly applicable to all employees by way of compensation commuted pension retirement gratuity and contributions to the Employees Trust Fund. Furthermore dividend income from substantial participations may be taxed at a lower tax rate based on domestic federal and cantonal law.

Corporate Tax Rates Around The World Tax Foundation

Individual Income Tax In Malaysia For Expatriates

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

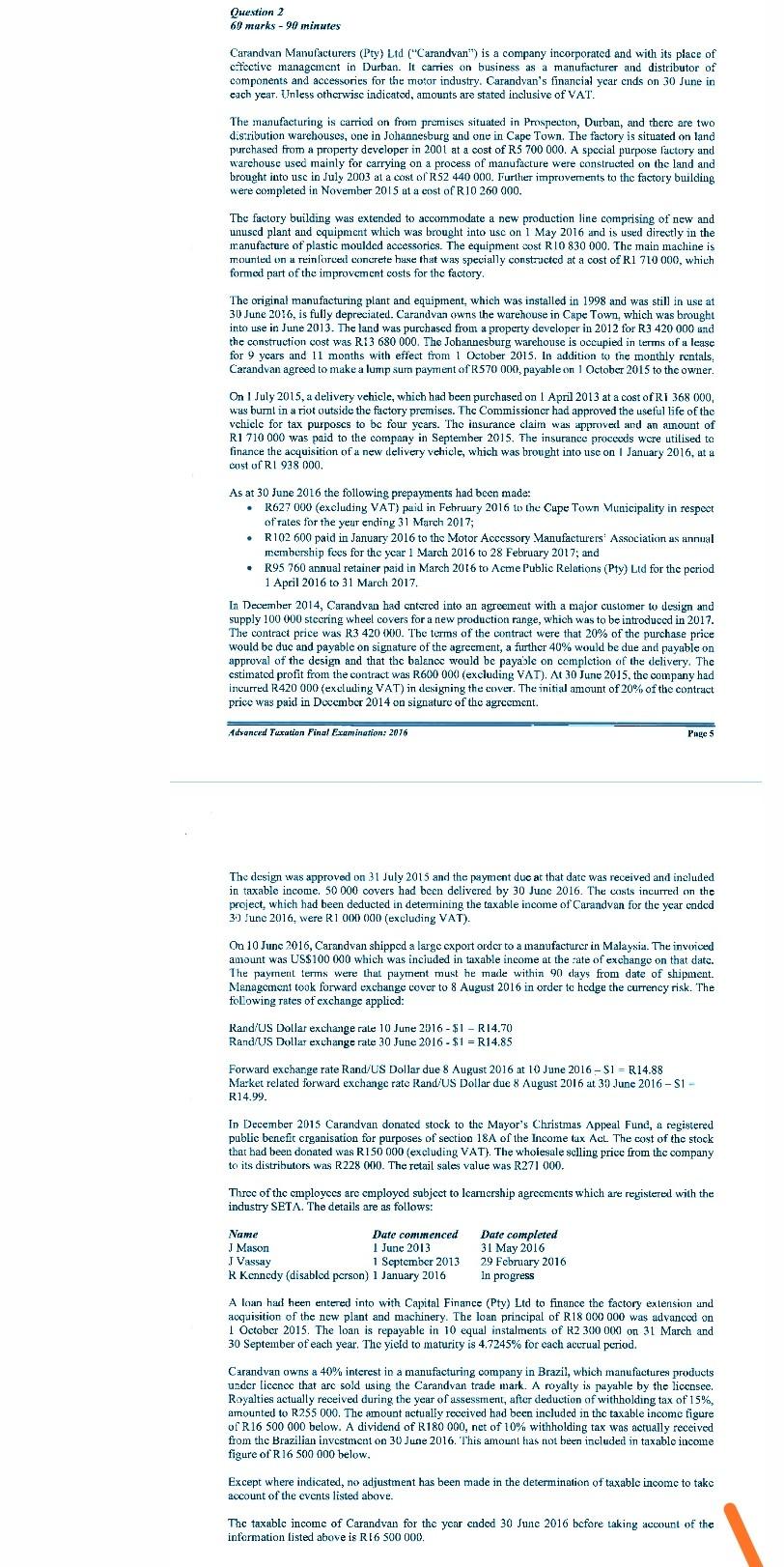

Solved Question 2 69 Murks 90 Minutes Carandvan Chegg Com

Malaysian Tax Issues For Expats Activpayroll

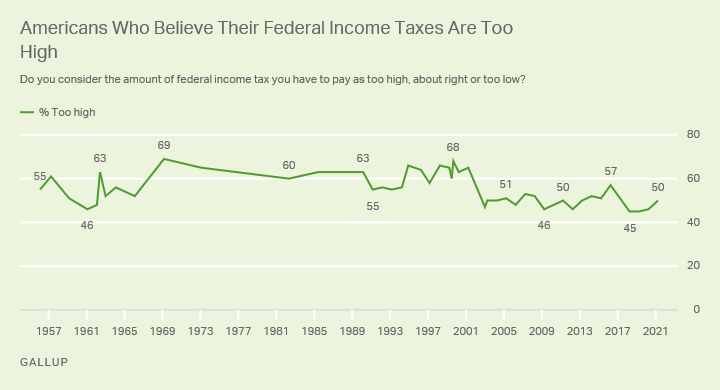

What S Driving Americans Views Of Their Taxes

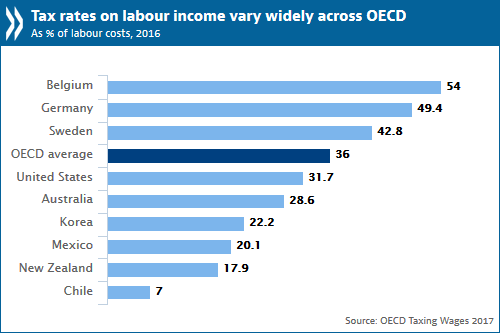

Oecd Tax Rates On Labour Income Continued Decreasing Slowly In 2016 Oecd

South Korea Corporate Tax Rate 2022 Data 2023 Forecast 1974 2021 Historical

Income Tax Malaysia 2018 Mypf My

Why Black Women Are Paying More In Taxes Than Washington S Billionaires Ywca

Malaysia Direct Tax Revenue Statista

Taxable Income Formula Examples How To Calculate Taxable Income

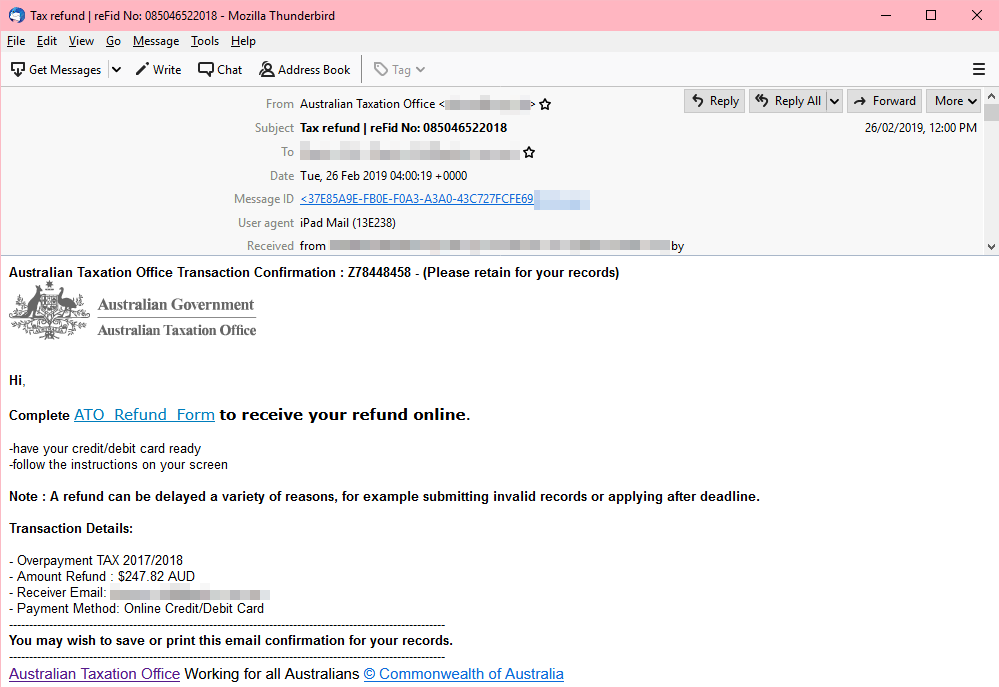

What You Need To Know About Tax Scams Security News

15 Types Of Tax Free And Non Taxable Income Bankrate

Malaysian Taxation 101 Inheritance Tax And You Secure Your Seat Now Https Goo Gl M4jgpr Is Inheritance Tax A Fact Or Myth Richard Oon 25 Years Experience In Taxation Is Going To Share

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

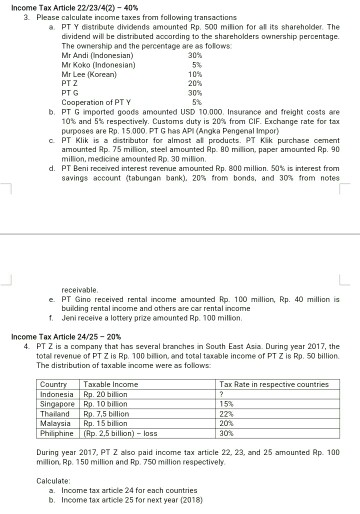

Taxation Solution 2017 September Pdf Withholding Tax Tax Deduction

Amazon Paid 0 In Federal Income Taxes Last Year Infographic

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Comments

Post a Comment